The world has been turned upside down by the COVID19 pandemic and the mortgage industry has not been immune to those changes

As an industry we been on a rollercoaster ride with interest rates as the market adjusts with every bit of information that comes out about the pandemic. We have also had to quickly adjust to having employees work remotely to keep everyone safe.

In some states, such as California, the governor has issued shelter in place orders which means that doing face to face business is not allowed with the exception of industries which are considered to be essential services.

The California Association of Realtors told it’s members that they are to stop all property showings, listing appointments, open houses, property inspections and any face-to-face marketing or sales activities.

But what about appraisers?

No one would think of them as an essential service for the general public during this COVID19 crisis but appraisals are essential for the mortgage process.

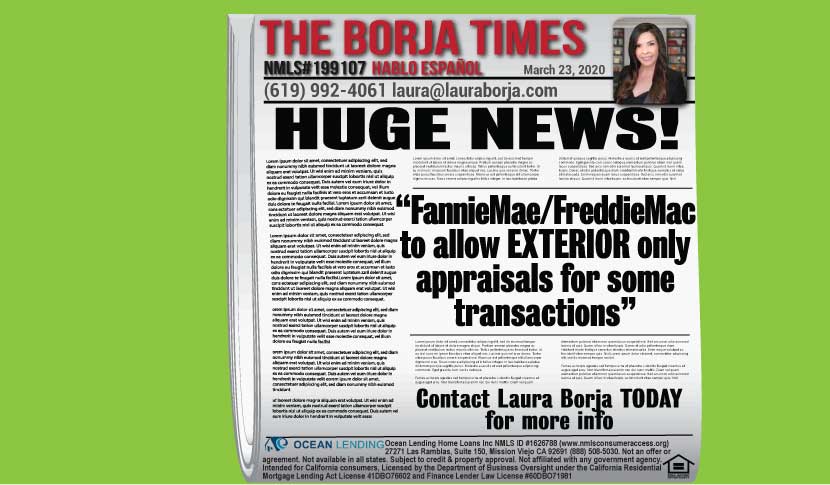

I have not seen an official notice from any appraiser organization, but lenders received bulletins from FannieMae and FreddieMac addressing the issue.

Purchases of primary residences of up to 97% loan to value will be allowed to use exterior only or desktop appraisals. The temporary flexibility will also apply to second homes and investment purchases with at least 15% down.

No cash out refinances with any occupancy will be allowed to go with an exterior only appraisal with one caveat. The new loan must go back to the current owner of the mortgage.

What does that mean?

For most most conventional financing, the mortgages are owned by either FannieMae or FreddieMac. That doesn’t mean that is who you make your payment. It does mean that is who purchased your loan when it was sold as a part of a MBS bundle. Read more about that here. Jumbo loans and non traditional financing are rarely owned by either agency.

So, if FannieMae owns your current loan and the loan is going back to FannieMae, you are good to go. Same applies to FreddieMac. How do you know who owns your loan? You can look it up by going to one of these links.

https://www.knowyouroptions.com/loanlookup or https://ww3.freddiemac.com/loanlookup/

This temporary guidelines means that Conventional purchases and refinances can continue through the process even during the COVID19 shelter in place order. This is a great relief for those who were worried that the mortgage industry was going to be brought to a screeching halt by the inability to obtain appraisals.

I do want to clarify that this temporary guidelines DO NOT apply to VA, FHA or USDA loans as they do not fall under the FannieMae or FreddieMac umbrella. Also, the temporary guideline for conventional loans is only valid until May 17,2020.

Have questions?

Send me an email

Give me a call – (858) 3-LOANS-3

Text LOANINFO to 44222

Connect with me on Social Media.

Please hit the like button if you enjoyed the Article. Share it with your friends. And of course, don’t forget to subscribe.