The Economic Impact Payments are eagerly awaited by many of us in the US. However, the way the policy is written, the payments will leave many out in the cold, or at least a bit chilly.

But first, please note that I am NOT a tax expert and you should consult a tax professional or the IRS for specific questions.

Who is eligible?

U.S. residents will receive the Economic Impact Payment of $1,200 for individual or head of household filers, and $2,400 for married filing jointly if they are not a dependent of another taxpayer and have a work eligible Social Security number with adjusted gross income up to:

- $75,000 for individuals

- $112,500 for head of household filers and

- $150,000 for married couples filing joint returns

People making over the figures above could be eligible for reduced payment. Also, those with qualifying children on their tax return could receive an additional $500 per child.

The important thing to note in that eligibility description is that someone who is claimed as a dependent cannot receive the payment, even if they work and file their own tax return.

How are are economic impact payments falling short?

Let’s look at who is going to be excluded and you will quickly find out.

There are many working adults who are claimed on someone else’s tax return because that person covers the majority of living expenses. Being claimed as a dependent will automatically disqualify the person from receiving the help. And because the bill was written in such a way that only a qualifying child will yield additional economic impact payments for the household, the additional $500 is out of the picture if your dependent is 17 or older,

What are some examples of this situation?

- Students claimed as a dependent who also work to help cover school and living expenses who files a tax return and lost their income due to COVID-19

- Households with children who are full time students but over 17

- A disabled person over 17 being claimed as a dependent on someone else’s tax return.

- Your parents who you take care of and count on your financial support will not qualify you for additional payments.

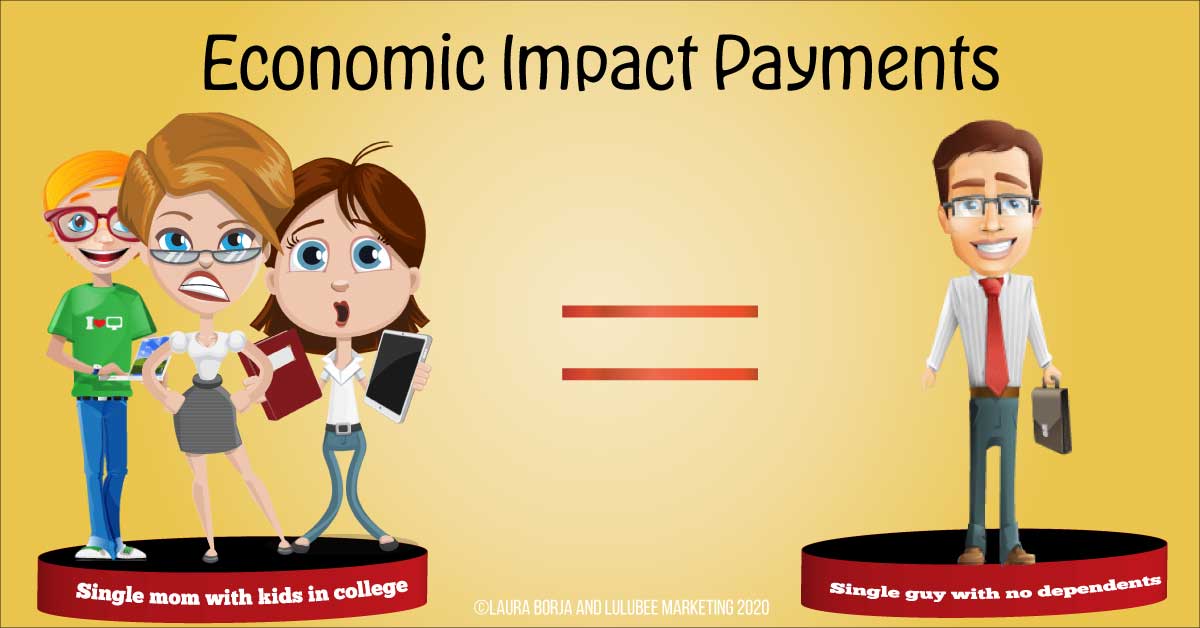

Both you and your dependent will be missing out on assistance. If you are a household where the dependents on your tax return help contribute to the household budget, you will receive the same help as a single person with no dependents. This is the case even if your dependent lost their income and is not longer able to contribute to the household. And your dependent will not receive any help because you claimed them as a dependent. Kind of a catch 22.

What do I think about this hole in the policy?

I think the bill is falling short for many of needing the additional assistance. I think either all dependents should be eligible for the $500 additional payments or that those who do file returns should receive their own assistance if they file a tax return.

What do you think?